are 529 contributions tax deductible in south carolina

For 2019 that amount. The limit is equal to the annual gift tax exclusion amount.

529 Tax Benefits By State Invesco Invesco Us

Tax Benefits of 529 College Savings Plans.

. South Carolina How to deduct frontloaded 529 contributions for state income tax purposes. Click to see full answer. In your South Carolina return look for the screen Heres the income that South Carolina handles differently.

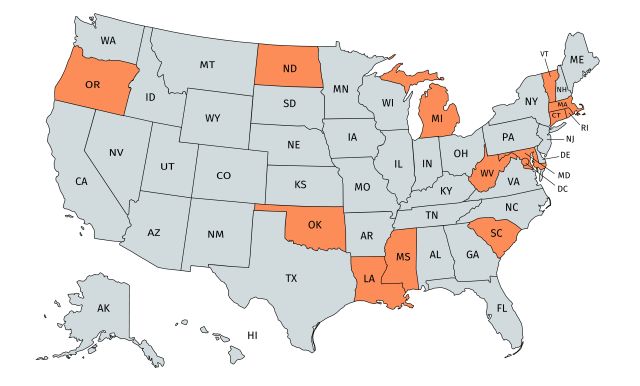

In Colorado New Mexico South Carolina and West Virginia 529 plan contributions are fully deductible in computing state income tax. In fact the limits are the same no matter whos. For most taxpayers there is.

Contributions made to a 529 plan technically known as a qualified tuition program or QTP may be deductible for South Carolina income tax purposes. Yes South Carolina taxpayers can claim a tax deduction on the full amount of their 529 plan contribution. Contributions to a South Carolina 529 plan are fully deductible - no limit.

If you file a South Carolina tax return either as a resident or a non-resident you may be eligible for additional tax advantages. You can contribute up to 15000 per year 30000 for married couples. What happens to a South Carolina 529 Plan if not used.

This means that South Carolina taxpayers can deduct any amount they contribute to an SC 529 plan as long as they have the income to deduct. 1 Best answer. Contributions to a single beneficiary across all 529 accounts cannot exceed 520000.

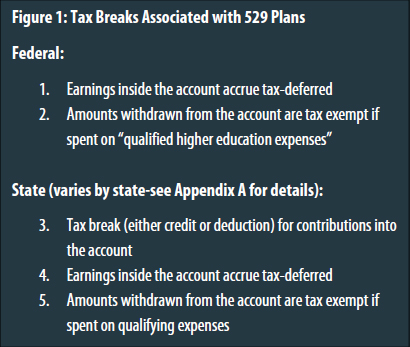

Grandparents can contribute to and even start a 529 college savings plan for their grandchildren. In fact South Carolina is one of six states where you can still make a contribution to the state administered 529 plan Future Scholar and claim a deduction for the prior tax year up. Although contributions are not deductible earnings in a 529 plan grow federal tax-free and will not be taxed when the money is taken out to pay for college.

While the tax attributes of a 529 plan are like a Roth IRA 529s allow for much more hefty annual contributions. Ohio residents can deduct up to 4000 per beneficiary per year on their state taxes. Oklahoma allows individuals to deduct up to 10000 per year and joint filers to deduct.

February 22 2021 1037 AM. The 1099-Q for the. To get started you can deposit 250 or set up an automatic monthly plan or payroll deduction plan for 50 a month.

There can even be multiple accounts for the same child as long as all combined contributions across these accounts do not exceed 520000 in South Carolina. Although contributions arent tax-deductible the earnings in a 529 account arent subject to tax treatment by the state or federal government when theyre used to pay for. The answer is yes.

There is no time in which the funds within a South Carolina 529 plan. Since contributions can add up to. Columbia Management Group LLC.

South Carolina taxpayers can deduct 100 of their contributions on their state tax returns. Yes South Carolina taxpayers can claim a tax deduction on the full amount of their 529 plan contribution. Here are the special tax benefits and considerations for using a 529 plan in South Carolina.

Future Scholar account contributions may be tax-deductible up to. 36 rows Most states limit the amount of annual 529 plan contributions eligible for a state income tax. 100 of contributions are deductible but do you deduct a proportional amount from income.

Using A 529 Plan From Another State Or Your Home State

529 Tax Deductions By State 2022 Rules On Tax Benefits

Save Money With South Carolina 529 Tax Deduction Future Scholar

An Alternative To 529 Plan Superfunding

529 Plans Which States Reward College Savers Adviser Investments

529 Plan State Tax Fee Comparison Calculator 529 Plans Nuveen

10 Things Parents Should Know About College Savings

Can I Use A 529 Plan For K 12 Expenses Edchoice

Preventing State Tax Subsidies For Private K 12 Education In The Wake Of The New Federal 529 Law Itep

South Carolina 529 Plans Learn The Basics Get 30 Free For College

529 Comparison Search Tool 529 Plans Nuveen

How Much Is Your State S 529 Plan Tax Deduction Really Worth Savingforcollege Com

Answering Your Questions About Saving Early And Often With A 529 Plan Bright Start

529 Accounts In The States The Heritage Foundation

What S A 529 Plan Can I Offer A 529 Plan As An Employee Benefit Ask Gusto

How Do I Choose A 529 Morningstar 529 College Savings Plan College Savings Plans Saving For College

Pin On 529 College Savings Plan Board 529 Plans

529 Plans Which States Reward College Savers Adviser Investments